clay shrinkage movement.

So I’m buying a house and it turns out the two years ago they started an insurance claim for movement and it was completed before they put the house on the market.

Basically the house had movement due to vegetation.

There was minor cracking throughout the house. Most internal cracks were 1-3 mm. The external ones were up to 10mm.

As per recommendations the offending trees have been reduced or removed. The insurance company have repaired all the cracks.

So the question is how should I look at the house now I know about the movement?

Do I say the house has had a lot of money spent on it and is worth what I originally agreed?

Or do I say that the shine has been taken off the house and I should try to negotiate a modest 2-3% price reduction?

Or do I say that they have literally papered over the cracks, there is a risk of the unknown when you start stripping the wallpaper put up 3 months ago, that there is a possibility that it affects future saleability and there could be unforeseen costs or complications. In which case is a 5-10% price reduction appropriate?

Comments (26)

Jonathan

Original Author4 years agoJust bumping this poll as it doesn’t seem to have turned up on my feed

Gabby Wong

4 years agoOther thing you could do is phone an insurer to try and get an idea whether they Consider it a risk and would make you pay more or be more challenging to insure... if they do then it helps strengthen your negotiating position, and if not it would be reassuring for you... just not sure how easy it would be to get that info from them!

K D

4 years agoWe had this, and it was stressful deciding whether to go ahead, but we got so much information on what had happened and what the insurers had done that we went ahead with no price drop. In effect, the work done had effectively improved the property as it was guaranteed for 20 years, plus we got some insurance quotes with us actively discussing the issues in the past and were told it had no impact, we were fully insured against future subsidence, and the premium was no more. So, if you can get enough background info, I’d say you could reassure yourself.

Sonia

4 years agoMy sister‘s house had been underpinned due to movement before she bought it. I don’t know the full facts I’m afraid but they did buy it very cheaply. There have been no further problems (they bought it in 1999) and have recently extended with no issues. My brother, who is a builder said an underpinned home is very secure, probably more than a un-underpinned house, for what it’s worth. Why don’t you contact your current insurer for advice? I think if you decide to go ahead, put in a reduced offer, simply because it can put people off and the current owners will be grateful for your offer. Sounds a bit callous in know, but that’s life I’m afraid.

Jonathan

Original Author4 years agoThe house hasn’t been underpinned, as I understand it this is only needed in very few serious cases. Some of the cracks have a steel strengthening brace but for the most part the cracks were minor (although they were in 13 of the 15 rooms of the house! )

Separately the work comes with a certificate of adequacy. I suspect a 20 year guarantee would feel far more reassuring.Gabby Wong

4 years agoThe reassuring thing I guess as well is that it was due to vegetation... and the trees have gone...

however is there a risk as the roots die away completely they Could leave a void in the ground underneath? Is this a thing? (I feel like I’ve heard it somewhere, but not sure and don’t have time to do the research now I’m afraid)

Jonathan

Original Author4 years ago@Sarah U-S it seems to me that a structural engineers report will note the external repairs but then add disclaimers that they don’t know internally what is under the wall paper that they recommend digging bore holes and a drains report would be prudent. Both of these are on the file from 12 months ago.

As I understand it structural engineers can’t offer any warranty on the house or the works completed. Am I missing something that they might add?Sarah U-S

4 years agoGosh - I feel for you!

Is it the dream forever house? If it is, and if you have all the Insurance’s in place and guaranteed, I’d perhaps risk it. I’d also perhaps risk reducing my offer a tad.

If it’s not the dream house, I’d be more tempted to walk away. I’m a firm believer in having that funny feeling when you know it’s your dream house and it’s meant to be... (absolutely no practical advice at all!!!!!)Tani H-S

4 years agoThe only thing I will add is that if you are having doubts about it now - then think of future buyers and when you come to sell. If you plan on staying in it a long time then you can always have a report done down the line to check for any further movement before coming to sell.

Jonathan

Original Author4 years ago@Sarah U-S thanks- it’s not a forever house so I want to gauge how people feel about the work..... if it affects future saleability it affects what I’m prepared to pay now.

Tani H-S

4 years agoPs personally I wouldn’t want to buy a house that had such issues unless it was a lot cheaper than market value because people expect that ie to make an allowance in case they need to pay to correct anything down the line.

Even a long guarantee means nothing if the company no longer existSarah U-S

4 years agoAs it’s not the forever home, I think I’d walk. As Tani says - resale will be tricky, and guaranteed only work if the company still exists - something I found out when I naively bought my first house!!

Good luck - let us know what you eventually decide to do!

Jonathan

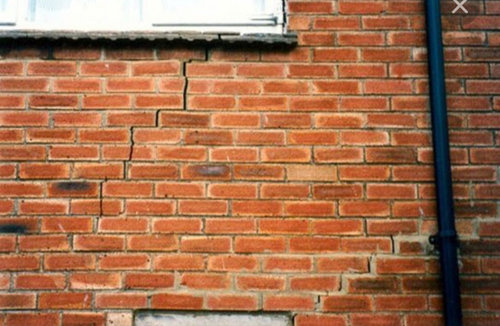

Original Author4 years agoPs- people do of course realise that the picture of the cracks on the red brick house are just illustrative- there is nothing to be seen on the house I have offered on.... only some pointing is new.

Tani H-S

4 years agoIs there any specialist you can get in - or contact the company that repaired them to get a better idea of the longevity of the repairs and any future possible movement to put your mind at rest? Can you get insurance again for it in case it gets worse?

When we sold our first house we had to pay out for an extra insurance indemnity because we were on an Unadopted road (even though it’s the buyers who should have paid for it!) because there wasn’t much info about it so they just didn’t know what it involved (ie road maintenance etc) it was a pain but reassured our buyers so worth it.

Ultimately it boils down to your gut feeling about it and if you are confident that it’s all fixed and won’t be an issue in the future. Might still be worth trying to get an idea of any future costs should something happen so you can renegotiate a better price?

Earl & Calam Design and Build Ltd

4 years agoNotice you say clay shrinkage movement and not the S word. (subsidence). Is this the terminology the sellers side are using? Lots of insurance companies wont insure a house that has had subsidence and it can cause problems with insurance and future sales. Generally in both situations you will need to tick a box saying to your knowledge the property hasn't been effected by subsidence. if you look at the definition of subsidence it covers clay shrinkage, so its a fine line! If you are getting the property at a good price and the issue has been dealt with well and you continue to control the trees so it doesn't reoccur then it could be OK. Things to watch for are has there been an ingress of water over time though the cracks that could have effected anything? Timber internally? Hope that makes sense. Not voting in the poll as there are too many unknown factors to cast a proper vote. Hope that helps.

Jonathan

Original Author4 years ago@Earl & Calam Builders Ltd

Thanks for your reply. I purposely omitted the s word as I didn’t want to skew the poll with a word that is inflammatory for some. But I am realistic about what it actually is and will declare it with insurers- I suspect the premium will be higher because of the recent claim and this will influence how much I am prepared to pay.Anthony (Beano)

4 years agolast modified: 4 years agoSorry I missed this :-(

tbh it wil always be regarded as a house that has had issues and this will always affect the price, now and future sales, it’s just like a damaged car, you will never get the same as a straight, undamaged version in the same car!

id check in insurance with full disclosure and see what the quotes are, if your happy, that and a LARGE reduction in price, I might me temptied but without that I’d walk away!

how did you find out? How much other intrest was there in it?

Jonathan

Original Author4 years ago@Beano

We were first in the door and made an asking price offer as apparently (and believably) there were lots of waiting viewers and the comparables suggested the asking price is ok.

The sellers form disclosed the insurance claim and we asked for significant extra information. We have about 70 pages of surveys and claims quotes so feel informed..... but ultimately we offered the top price and have since found out the house had problems so are undecided how to view it.... hence the post on Houzz.

On the one hand the house has had significant money spent on it.

On the other hand a lot of the money spent was wallpapering the entire house..... I always intended to strip it all off but I’m left concerned about what is underneath and I’m concerned about unforeseen costs and I’m irrationally concerned about future movements even though the cause of the problem has been removed.

So I have already decided I want to renegotiate the price, I have a figure in mind and so I’m sense checking that figure. TBH the poll so far has been very illuminating- it seems people think a large price reduction is needed to offset perceived risk now. I suspect that if we sold the house in 3 years and at that time there is no evidence of further movement there wouldn’t be the same perceived risk but we would still have to disclose it.Ribena Drinker

4 years agoThe way I see it is that if you buy it and look to re-sell in say 3-4 years, will there be a Jonathan equivalent making a similar enquiry and canvassing opinions about buying?

I think that as it isn't your 'forever' home, whereas you may be happy to accept a house with 'history', you may find it's either difficult to shift or somehow the price is depressed when you come to sell it someway down the line.

I don't think it's so much about the issue and the remedy, I think it's more about the fact that there has been an issue. I don't think some folks will be able to see beyond that.Anthony (Beano)

4 years agoTbh Jonathan I think you have done the right thing! I don’t think you could have lived with any ease in that house, it will probably sell but who knows what the claims could made by buyer on the seller after all was eventually reviewed after wallpaper stripped and drains addressed, better off out of that headache :-)

Reload the page to not see this specific ad anymore

JonathanOriginal Author